Celebrity Estate Plans Series Part 1 of 4: Michael Jackson

What is it about celebrities that always draws us in? For whatever reason, we just can’t resist a good, juicy celebrity story. So, for the next few weeks, we will look at the lives of 4 celebrities and see what we can learn from their stories.

This week, we’re turning the spotlight on Michael Jackson. Even if you aren’t old enough to “Remember the Time” when Michael Jackson was dominating the charts, by the end of this article, you’ll see that he left holes in his estate plan that we can learn from.

Now, let’s dive in and learn how to avoid the same fate for your loved ones.

It’s As Easy as “ABC” (and 1, 2, 3)

Before we look at the specifics of Michael Jackson’s story, let’s dispel a myth about estate planning: You need not be rich, philanthropic, or famous to need estate planning. You need estate planning if you own anything – even a bank account – and have people in your life you love. It’s as simple as that (dare I say it’s as simple as “ABC” and 1,2,3?). So, as you think about your estate planning, it’s time to “Beat It” past the misconceptions so your loved ones can empower you to do the right thing.

Creating a Will Alone is a “Bad” Choice

So what happened in Michael Jackson’s case? His estate plan included a Will, which established trusts for his mother, Katherine, and his three children, Paris, Prince, and Bigi.

Let’s stop because this setup already has an increased potential for conflict.

When your assets pass via “Will” (instead of via Trust), your assets must go through a court process called probate. Subjecting your assets and your family to probate can result in a long, time-consuming, public, and messy court process that can be unnecessarily expensive to resolve.

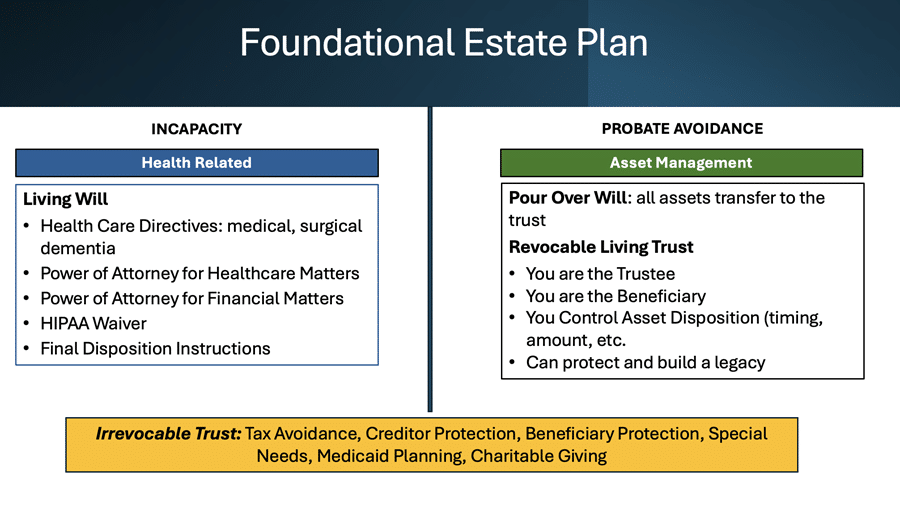

A trust, on the other hand, bypasses the court process altogether as long as your assets are owned in the name of the trust when you become incapacitated or when you die. If your assets are appropriately transferred and retitled into the trust (called “funding” the trust), your estate can be administered privately and often takes less time than the court process. A trust can be set up and funded while you’re alive, thereby avoiding probate, or it can be a part of your Will. When it’s part of your Will, like in MJ’s case, it isn’t established or funded until after the court process. So, if you’re trying to keep your family from going through the court process, putting a trust in your Will completely defeats the purpose.

Since Michael Jackson’s assets passed via a Will, there have been ongoing legal matters in court, which still haven’t been resolved in the 15 years after his death. MJ’s family is embroiled in a dispute with the IRS, so the trusts he intended to create for his mother and children remain unfunded. Therefore, some of his assets cannot be transferred to them as he planned. It’s also highly probable that the legal disputes continue to cost the estate a lot of money. That’s money that otherwise would have gone to his mother and children.

Taxes – A Potentially “Dangerous” Situation!

The Jackson estate’s ongoing battle with the IRS is a stark reminder of the tax implications that can affect your plan and your loved ones. When it comes to taxes, you can’t think in terms of “Black or White.” If you intend to avoid as many taxes as possible, you don’t want to cut corners by doing your estate planning cheaply or independently. That could be “Dangerous!”

Taxes can significantly reduce the value you pass on to your heirs, directly impacting your loved ones. So, our next lesson from Michael Jackson’s story is that the stakes are too high to attempt alone when it comes to saving money on taxes. Work with a professional who can advise you properly. We aren’t clear why Michael Jackson didn’t get the support necessary to minimize taxes and protect his estate from a long, drawn-out court process, but we know we can help you and your loved ones.

Avoiding the “Thriller” of Legal Disputes

The Jackson case also highlights the importance of choosing the right representatives for your estate. These are the people who handle your affairs after you’re gone (they’re called “executors” if there’s a Will or “trustees” if there’s a Trust). MJ’s family members have criticized the representatives for the way they’ve managed the estate. In particular, Katherine Jackson has alleged that the executors have been too frugal and are holding onto assets to maintain control.

Conflict between your representatives and your loved ones is always possible. To help minimize the potential, we recommend you communicate your intentions to your representatives and loved ones during your lifetime. Consider holding a meeting so everyone knows your wishes and understands the intent behind your decisions. You may not be able to “Heal the World” on your own, but you can promote healing within your own family and prevent future conflict by opening the lines of communication now.

Also, know that you don’t have to choose family members to be your representatives – even if you feel pressured. If you aren’t sure who the “right people” are, think about people you know who are trustworthy and capable of handling complex financial and legal matters. There’s also the option of choosing a professional representative, as Michael Jackson did, who might be more appropriate for your situation.

Our two final lessons from Michael Jackson’s story are: 1) Communicate your wishes openly to your representatives and your family, and 2) Choose the right people to act for you when you no longer can.

“You Are Not Alone” – We’re Here for You

By learning from the challenges faced by Michael Jackson’s family, you can ward off the possibility of a similar outcome for your loved ones. Your careful planning today can pave the way for a smoother transition of your assets in the future, ensuring that you can support your family after you’re gone rather than creating a mess for them to handle without you.

It’s “Human Nature ” to want to avoid thinking about your death, much less plan for it. We get it. But we can live a more fulfilling life when we face our mortality. The good news is that you don’t have to deal with it alone. We’re here to support you every step of the way.

We help you create a comprehensive Life & Legacy Plan from a place of education and intention so that your loved ones stay out of court and conflict and you can minimize taxes. Once you’ve created your plan, you can rest easy knowing your wishes will be honored, your loved ones cared for, and your legacy preserved.

Schedule a complimentary 15-minute consultation to learn more.

Contact us today to get started.

This article is a service of Life & Legacy Law, a Personal Family Lawyer® Firm. We don’t just draft documents; we ensure you make informed and empowered decisions about life and death, for yourself and the people you love. That’s why we offer a Life & Legacy Planning™ Session, during which you will get more financially organized than you’ve ever been before and make all the best choices for the people you love.

The content is sourced from Personal Family Lawyer® for use by Personal Family Lawyer® firms, a source believed to be providing accurate information. This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal, or investment advice. If you are seeking legal advice specific to your needs, such advice services must be obtained on your own separate from this educational material.