info@life-legacylaw.comLicensed in Colorado & New Mexico

Personal Family Lawyer®

Fluent in Sign Language

Personal Family Lawyer®

Fluent in Sign Language

Create a legacy of significance.

At Life & Legacy Law, we partner with entrepreneurs and founders to help launch, protect, and scale their businesses with legal confidence. Whether you’re just forming your startup, structuring a founder-friendly operating agreement, preparing for a capital raise, or negotiating critical contracts with investors, vendors, or partners — we bring the legal insight and strategic guidance you need.

As startup business lawyers, we understand the fast-paced, high-stakes nature of early-stage ventures. Our goal is to remove legal friction so you can focus on growing your company — with peace of mind and a solid legal foundation behind every decision.

From idea to exit, we support you through every stage of business growth:

Let us help you turn your startup into a legacy.

At Life & Legacy Law, your estate lawyers, we plan for both life and death. Our primary goal is to keep you and your loved ones out of conflict and out of court.

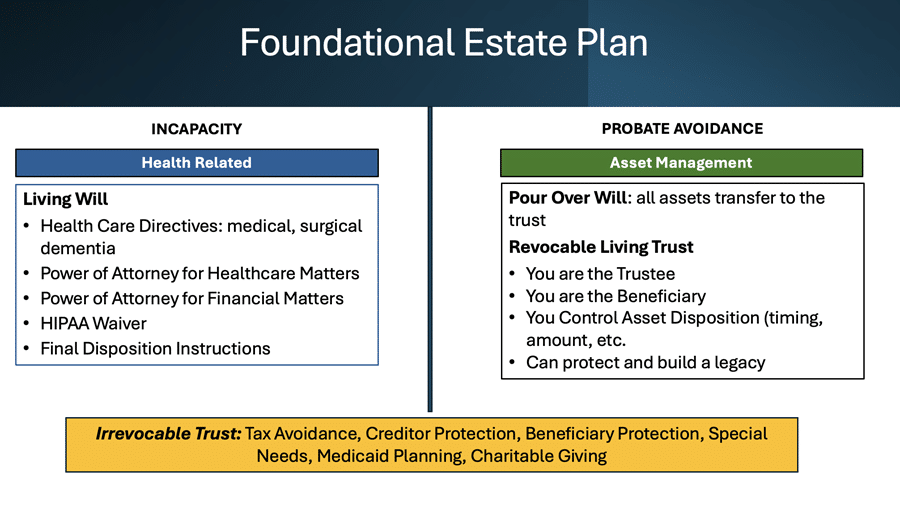

Every adult, regardless of age, should have a Foundational Estate Plan. This plan addresses what happens to you and your assets if you become incapacitated or pass away. Without a plan, the state takes control—and that can be costly, time-consuming, and emotionally draining for your loved ones.

“Probate” is the court-supervised process of distributing your assets after death. In Colorado and New Mexico, probate typically lasts 12–24 months—even for simple estates—and legal fees can cost 3 to 4 times more than the cost of a Foundational Estate Plan.

Without proper planning, your personal and financial information becomes part of the public record, and your loved ones may face delays, unnecessary legal battles, and lost inheritance.

Our Foundational Estate Planning process helps you:

Our plans are also flexible, highly private, and can include asset protection for your heirs from divorce, creditors, and lawsuits. We also offer tax planning strategies to minimize potential tax burdens.

With your completed Foundational Estate Plan, you’ll receive a comprehensive package that includes:

Let us help you keep your loved ones out of conflict and out of court. Whether you live in Colorado or New Mexico, Life & Legacy Law, your estate lawyers, will guide you through the estate planning process with care, precision, and a focus on protecting your legacy.

Schedule a free 15-minute consultation today and gain peace of mind for tomorrow.

Let’s talk about the Elder Law lawyers Asset Protection planning process.

When someone applies for Medicaid, the eligibility requirements can be shocking. In Colorado and New Mexico, you generally cannot have more than $2,000 in countable assets or earn more than $2,901 per month (2025 limits). If you exceed these limits, you will not qualify and you will be subject to a penalty period before you can receive financial assistance.

Medicaid and VA programs also have a ‘look-back’ period—5 years for Medicaid and 3 years for VA Aid and Attendance—during which they review financial activity. Gifts or transfers during this period can trigger penalties.

We help clients prepare early using tools like the Medicaid Asset Protection Trust (MAPT) to move assets out of countable ownership and preserve eligibility.

We will meet multiple times to fully understand your personal situation. Every client receives a customized plan based on their health, family, income, and goals. We’re happy to collaborate with your CPA or financial advisor to ensure your needs are met.

At Life & Legacy Law, we are elder law lawyers who understand the emotional and financial challenges families face when planning for aging, long-term care, or incapacity. Our mission is to provide clear legal guidance and compassionate support so you can plan confidently for the future.

With the cost of long-term care on the rise—nursing homes in Colorado and New Mexico now cost between $9,000 and $12,000 per month—it’s no wonder many families feel overwhelmed. Questions like “How will I pay for this?” and “Will I qualify for Medicaid or VA Aid and Attendance?” are common.

At Life & Legacy Law, we focus on your lifetime needs—and what happens after. We help ensure your wishes are honored while you’re well, if you become ill, and after your death.

We offer:

An Elder Law Attorney is an advocate, strategist, and protector. We help ensure you have the resources to pay for long-term care while protecting your assets, so you can leave a legacy to your loved ones.

Without advance planning, you may be forced to spend down nearly all assets—including your home—before getting help. Even after death, Medicaid may recover costs by forcing a sale of your home. Our mission is to prevent this outcome with thoughtful, proactive planning.

Who is the ideal client for long-term care asset protection?

Don’t wait for a crisis. Schedule a free consultation and let us help you protect your assets, maintain control, and preserve your legacy.

If you choose to work with Life & Legacy Law, it is because you want to ensure that your children, your loved ones, and your business will be taken care of in the best way possible and will be properly prepared to receive your wealth, when it is time.

Our goal is for you to know with all certainty that you made the best decisions for your family during your lifetime, and that your family will be left knowing that your preparation was an act of love.

We have a unique system to give you the same access to services that was previously only available to the super rich. We provide the guidance you need to build and maintain a life of prosperity and to leave a legacy of family wealth.

Our system is designed to serve growing families who experience lots of change on their way to success. We are here to support you in planning not just your legacy (what you leave behind when you are gone), but for your life.

For instance, we provide counsel that will help you scale your business to another level of success, ensuring you are protected in all your relationships and that the deals you make will be a win-win for all parties. Our process will help you become extremely organized, as we will work to identify all assets and financial holdings, so that when the unplanned occurs (whether death or disability), your family and loved ones are more than prepared to carry out your plan, according to your wishes.

We are NOT here to just create a set of documents that likely will never be updated or looked at again. We ensure the most important details of your planning are followed through and with regular reviews, we help you make sure your plan continues to work throughout your lifetime and beyond.

We also believe that your family wealth is so much more than just your financial assets. It really encompasses everything you care about, your values, insights, stories, experience – your intellectual, spiritual, and human assets. We help you document, record, and faithfully transmit the totality of your family wealth during your lifetime so that you will leave a legacy of love that goes far beyond money, after you are gone.

I graduated with a JD from Stanford Law School and began my practice with an intense passion for the law. However, in my earlier days of practicing law, the experience was less than pleasant because everything was about conflict—the whole scene was overwhelmingly negative. I deeply wanted to be a part of something that was focused on building up people and relationships rather than tearing them down.

So, for a time, I changed focus. I received an MBA from the University of Texas at Austin and gained senior executive level experience in various businesses such as Dell, IBM, Flex International, Hope Foods, and Livengood Medical. Ultimately, when I found an area of practice and a way of practicing that is different, which is focused on truly helping people to avoid conflict and to avoid litigation, my soul was once again ignited with passion for the law.

I have finally found a way to integrate my passion for helping people plan and prepare for the unplanned (which I believe is an act of love) and helping them strategically grow and scale their businesses. This is why I started Life & Legacy Law.

At Life & Legacy Law, we understand that your business is more than just a way to make money. It’s an opportunity to create a lasting legacy that can benefit your family, your customers, and even the world.

Our team can work with you to create a comprehensive succession plan that enables your business to continue to thrive even after you’re gone, or if you are unable to lead your business. Working with other professionals, including tax and insurance experts, we can help you structure and implement a plan that minimizes the chances of legal challenges and sets the future generation of management up for success.

Leaving a Lasting Legacy:

Succession planning is crucial to the long-term success of any business, however, as a small business owner, you must recognize both the importance and difficulty of developing a Business Succession Plan.

Considering the future, you may believe that your business will end when you’re no longer able to manage it. Alternatively, you may anticipate that someone may purchase your interest, that your family members will take over management, or you may have partners to whom you plan on transferring ownership. Each scenario presents challenging questions, all with lasting legal, financial, and tax implications.

For instance, what if your family members don’t agree with your vision for the business, or they want nothing to do with it? What if your partners are not your family, and they don’t intend to employ or care for your family members? The key is to identify these potential competing interests as early as possible and brainstorm solutions with your professionals, thus avoiding unforeseen pitfalls.

To start a Business Succession Plan, follow these steps:

By planning early and consulting with your professionals, you can avoid unforeseen pitfalls and ensure a smooth transition of management or ownership, preserving your legacy and the future of your business.

With our expertise in estate planning, business formation, and corporate law, we can help you create a plan that protects your business legacy and ensures that your vision continues to make a positive impact for years to come. Let us help you leave behind a lasting legacy of significance.

Actions speak much louder than words. Below is what we try to live. If you share these values, chances are we will work well together.

We consider you and your unique situation.

We will care for what you entrust to us.

We will be honest, reliable, ethical and dependable.

We will listen to you and work with you to help you achieve your goals.

We will be forthright and honest while sincere and gentle.

We love our work and believe it is a privilege to care for you and your loved ones.

We are committed to providing comprehensive guidance throughout your lifetime and being there to support your loved ones when you can’t be thereby giving you confidence that you made the best decisions for your family during your lifetime, and that your family will be left knowing that your preparation was an act of love.

At Life & Legacy Law, we understand that legal jargon and the complexities of the financial, tax, and insurance world can be overwhelming for entrepreneurs. That’s why we simplify things for you. Our background in corporate law, along with our experience founding and exiting multiple businesses, and advising fellow entrepreneurs, means we can help you create and prepare to leave behind a legacy of significance.

2-Types of Relationships: We can work with you in either an event driven capacity or you can engage us as your outsourced General Counsel.

If you prefer a transactional or an event-driven relationship, we can help you with everything from formation to employment, client, supplier, and contractor agreements, protection of your intellectual property, incentive programs, and much more.

We charge a flat fee, so you can plan your expenses and won’t have to worry about us charging you by the hour in six-minute increments.

The best legal and business advice comes through a strong relationship built on trust, which is why we want to be your trusted business advisor – your outsourced General Counsel – supporting and guiding you from formation through sale or disposition.

Our Exclusive Member Plans are designed to help you choose the right level of service based on the estimated needs of your business. Each of our Member Plans allows you to save thousands of dollars on legal fees and amortize your costs into equal installments over the year.

We offer 3 options, each with a 12-month commitment, tailored to specific needs at various stages of growth:

☐ Silver Plan ($500/month) ☐ Gold Plan ($1,500/month) ☐ Platinum Plan ($3,000/month)

At Life & Legacy Law, we’re committed to simplifying the complexities of the legal, financial, insurance, and tax world, so you can focus on what you do best – growing your business.

Your participation in the Outsourced General Counsel Program requires an initial twelve-month commitment, and then renews annually automatically unless otherwise terminated.

We start with a free 15-minute call to assess your needs and our relational fit. If we both agree we are a fit, we will discuss taking the next step by scheduling a 2-hour Family Wealth Planning Session to review, analyze, and strategize over your unique needs.

To reserve this session, a $750 value, we will need to obtain a Credit Card which we will hold in our files to secure this session. However, you will only be charged if you fail to show up for this session or timely reschedule.

Once the Family Wealth Planning Session is scheduled, you will be emailed a Family Wealth Inventory & Assessment document (“Assessment”) which is designed to help us ensure that we create a plan that fully meets your needs. The information you need to provide will include such items as:

Please fill out the Assessment as best as you can. We understand that you may not have answers to every question, but please be as thorough as possible –the better you are organized, the easier it will be to design the right plan.

You will be asked to return this Assessment to us at least 7 days prior to your scheduled Family Wealth Planning Session. Without the completed Assessment (to the best of your ability), we will not be able to conduct the Family Wealth Planning Session.

This is a 2-hour meeting where we will review the Assessment and discuss what would happen if something were to happen to you now (whether death or incapacity), and then we will strategically discuss the planning options which will ensure your wishes are honored and your loved ones are not just cared for but will be kept out of conflict and out of court.

We will conduct a detailed question and answer session with the goal of creating various plan options where you can choose the Fees based on the complexity of the plan you feel is best suited to your needs. At this stage you will be required to sign an Engagement Agreement which sets forth the scope of services and fees to which we have agreed. This needs to be signed before we can begin working on your Estate Plan. At this time a 50% deposit will also need to be paid. You will be sent an invoice which can be processed though our secure and encrypted online payment portal.

Within 7-10 days after this meeting, you will be sent a Confirmation of Important and Missing Information by which we will gather any remaining information necessary to your plan as well as confirm the choices you have made for the disposition of your assets, the beneficiaries, guardians, powers of appointment, etc.

At this 2-hour meeting, we will review, and you will sign the plan documents which are scanned and returned to you (we do not keep original files). You will be provided a detailed color diagram of how your plan works and the various elements of the plan. All your documents will be delivered to you in a personalized binder keeping them organized and accessible.

If you have chosen a trust-based plan, we will provide you with extensive instructions to help you ensure that your assets are moved into the trust. This process is called “funding” the trust and involves retitling your assets to ensure that the assets are owned by the trust. If our engagement specifies, we can also handle the “funding” on your behalf.

At this meeting, we will review your progress in funding the trust and help you resolve any difficulties you may be having in completing the “funding” of the trust.

The most important part of this Final Meeting is the Family Wealth Legacy Interview. This will ensure that upon your death, your loved ones will have a meaningful record, on video, of you discussing your life, lessons, heritage (stories of your parents, grandparents, and relatives), as well as your love story, personal values, spiritual foundations, and any other priceless treasure you want to communicate to those you love.

In our experience, this Final Meeting has often left clients in joyful tears.