Medicaid Asset Protection Trusts Explained: How They Work and Why You Need One

One of the most effective long-term care planning tools available is the Medicaid Asset Protection Trust (MAPT). Many families are surprised to learn that nursing home costs can quickly deplete a lifetime of savings. Without proactive planning, even middle-class families may find themselves spending down assets just to qualify for Medicaid coverage.

In Colorado, Medicaid for long-term care—known as Health First Colorado—has strict income and asset limits that can disqualify applicants who haven’t planned ahead. Without proper planning, families often face “spend down” requirements that can quickly erode savings and even place the family home at risk.

A Medicaid Asset Protection Trust, often referred to as an irrevocable trust for Medicaid purposes, can significantly alter that outcome. It allows you to protect your home and other valuable assets while preserving your eligibility for Medicaid benefits later in life.

Before setting one up, it’s crucial to understand how MAPTs work, the rules involved, and common misconceptions that can cause costly mistakes.

What Is a Medicaid Asset Protection Trust (MAPT)?

A Medicaid Asset Protection Trust is a specialized irrevocable trust designed to protect assets from being used by Medicaid when determining eligibility for long-term care benefits. Once assets are transferred into the trust, they are no longer considered your personal property. Instead, the trust owns them.

The trust is irrevocable, meaning you cannot freely take assets back or change terms after it’s created. This lack of control is precisely what makes the trust effective for Medicaid purposes—because you no longer legally own the assets, Medicaid cannot require you to spend them on nursing home costs.

That said, you still maintain significant control through the choice of your trustee (often a trusted child or relative) and your ability to direct how assets are distributed after your passing. The trustee, who can be a family member or a professional, is responsible for managing the trust assets and ensuring they are used for your benefit and the benefit of your beneficiaries.

How a MAPT Protects Your Home and Savings

For most families, the primary goal of a Medicaid Asset Protection Trust is to protect the family home. When properly structured, the trust ensures your home won’t need to be sold to pay for nursing home care.

Here’s how it works:

- You transfer your home and other assets (like investment accounts) into the trust.

- You continue to live in your home for the rest of your life.

- The trustee manages trust assets on behalf of your future beneficiaries—typically your children.

- After you pass away, those assets are distributed according to your wishes, often outside of the probate process.

By moving ownership to the trust, your home is shielded from Medicaid estate recovery—the state’s effort to recoup costs after a recipient’s death.

In Colorado, the Estate Recovery Program is administered by the Department of Health Care Policy & Financing (HCPF). Without planning, the state may place a lien on your home or recover funds from your estate after your death to repay Medicaid expenses. A properly structured MAPT can prevent this outcome.

In addition, any income the trust generates can be paid to you (depending on the trust structure), allowing you to maintain some financial benefit during your lifetime.

The Medicaid 5-Year Look-Back Rule

Timing is everything with a MAPT. Colorado follows the federal five-year Medicaid look-back period for all asset transfers. This means any transfers made within five years before applying for Health First Colorado long-term care coverage can trigger a penalty period of ineligibility.

The state calculates this penalty based on the average monthly private-pay nursing home rate in Colorado, which changes annually. That’s why timing—and accurate guidance from a Colorado elder law attorney—is so important.

Because of this, the best time to plan is now, while you’re still healthy and independent. By creating a MAPT early, you can start the clock on that five-year period and secure your financial protection well before care is needed. This proactive approach not only ensures better protection but also provides peace of mind, knowing that you’ve taken steps to secure your financial future.

Common Misconceptions About MAPTs

- “I’ll lose everything if I put it in a trust.”

False. While you can’t use the trust principal for your own benefit, you still retain significant control over who manages the trust, who benefits, and how assets are distributed later. You can continue living in your home and even collect rental income if the trust holds property. This level of control and flexibility is a key advantage of a MAPT, enabling you to shape your financial future. - “I can just give my assets to my children instead.”

Direct gifts can create significant problems. Not only can they trigger tax issues, but they also expose your assets to your children’s creditors, lawsuits, or divorces. A MAPT offers legal protection and structured control that simple gifting cannot. - “It’s too late for me to plan.”

Even if you or a loved one is already facing nursing home care, some asset protection may still be possible through crisis planning. However, planning with a MAPT always provides the strongest security and the most options.

Why You Need a Medicaid Asset Protection Trust

Creating a MAPT isn’t just about protecting assets—it’s about preserving dignity, independence, and peace of mind. With the average cost of nursing home care in Colorado often ranging from $9,000 to $12,000 per month, depending on the region and level of care, even a short stay can significantly deplete savings. However, with a well-structured MAPT, you can rest assured that your home and legacy are secure, and you can qualify for Medicaid when the time comes, all while avoiding estate recovery. This can significantly minimize stress for your family during an already difficult time.

By setting up a MAPT, you can:

- Preserve your home and legacy for your loved ones.

- Qualify for Medicaid when the time comes.

- Avoid estate recovery.

- Minimize stress for your family during an already difficult time.

At Life and Legacy Law, we help families develop Advanced Asset Protection Plans that integrate tools like MAPTs into a comprehensive strategy. Our team ensures your trust is structured correctly, aligns with current Medicaid rules, and supports your overall estate planning goals.

Getting Started: Building on Advanced Asset Protection Planning

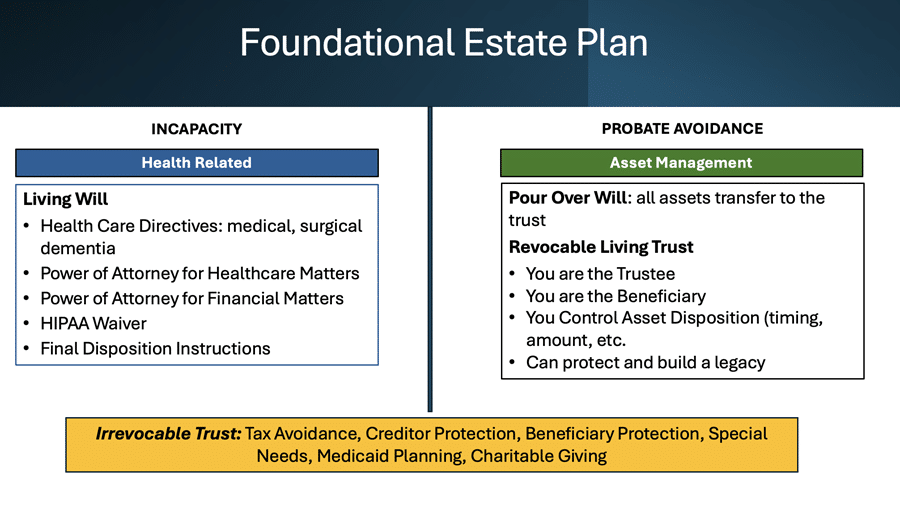

A Medicaid Asset Protection Trust is one of several tools in the broader field of Advanced Asset Protection Planning. If you haven’t already, start by reading our foundational blog: 👉 What Is Advanced Asset Protection Planning for Medicaid?, which provides a deeper understanding of the strategies available to protect your family’s future. Once you’re familiar with the basics, we can discuss whether a MAPT is right for your unique situation.

Don’t wait until it’s too late to protect what you’ve worked for. Contact Life and Legacy Law today to schedule a consultation. With the right strategy, you can safeguard your home, your savings, and your peace of mind.

This article is a service of Life & Legacy Law. We don’t just draft documents; we ensure you make informed, empowered decisions about life and death for yourself and the people you love.

This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal, or investment advice. If you are seeking legal advice specific to your needs, such advice services must be obtained on your own, separate from this educational material.