Family, Finances, and the Holidays: Start the Talk

The holidays are a time for togetherness, celebration, and reconnecting with loved ones. They’re also a rare opportunity to discuss something most families avoid: money, inheritance, and estate planning. While it might feel awkward to bring up end-of-life decisions over dinner or while opening gifts, thoughtful conversations about finances and planning can protect your family, prevent conflict, and create long-term security for generations.

Here’s how to approach the conversation in a meaningful and stress-free way.

1 | Share Your Intentions Ahead of Time

Many people feel uncomfortable discussing money, whether due to family taboos or fear of creating tension. To ease your loved ones into the topic, start the conversation weeks before your gathering. Casually mention that you’ve been thinking about your estate plan, your assets, and how your family will be cared for if something happens to you.

If you have regular phone calls or visits with relatives, use them to plant the seed gently. As your holiday gathering approaches, bring up the conversation more intentionally and coordinate with the host to schedule a dedicated time for a focused discussion.

2 | Set Aside a Time and Place

Trying to talk about estate planning in the middle of festivities rarely works. Schedule a quiet, private, and comfortable setting where everyone can speak openly without distractions.

Be upfront about the meeting’s purpose so no one is surprised. Create an agenda of the topics you want to cover, and set start and end times. This helps keep the conversation on track, ensures essential points aren’t overlooked, and reminds everyone that the goal is to start the conversation—not resolve every detail in one sitting.

3 | Explain Why Planning Matters

Make it clear that this isn’t about prying into anyone’s finances—it’s about providing for the family’s future security and wellbeing. Planning ensures everyone’s wishes are clearly understood and honored, reduces the risk of conflict or expensive legal battles, and can even bring family members closer together.

Sharing why this planning is important to you—whether it’s protecting a child, caring for an elderly parent, or preserving a family legacy—helps loved ones understand the benefits and approach the discussion with empathy rather than defensiveness.

4 | Share Your Own Planning Experience

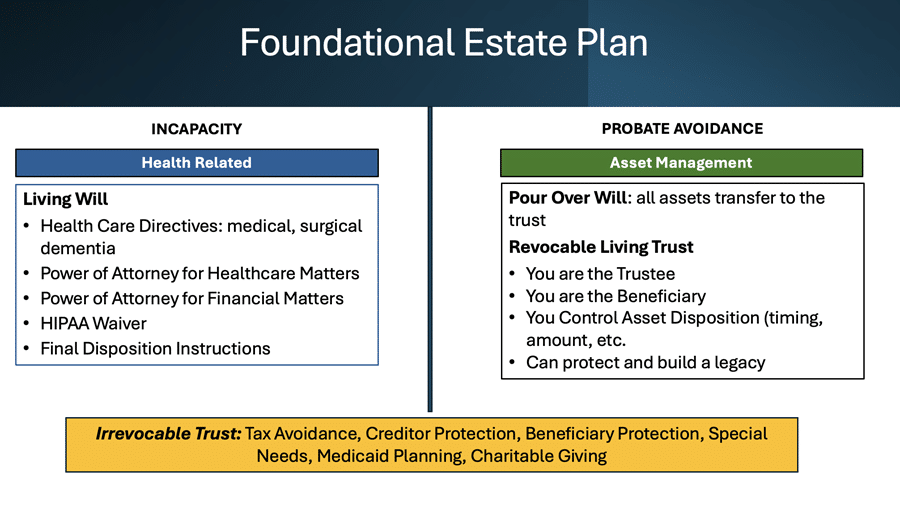

If you’ve completed an estate plan, use your experience to guide the discussion. Explain the process, why you chose specific planning tools, and the peace of mind it provides. Highlight any initial doubts or concerns and how they were addressed.

For those who haven’t created a plan yet, share your motivation for starting. Whether it’s avoiding family conflict, securing the future of a disabled relative, or building generational wealth, focusing on the benefits can inspire others to take action.

If you work with our firm, describe how they supported your unique needs. Offering resources, training, or family sessions can also help relatives feel more comfortable engaging in planning.

Bringing Families Together

Talking about money and estate planning isn’t easy—but it’s worth it. With preparation, honesty, and empathy, these conversations can strengthen family bonds, provide clarity, and ensure everyone is protected financially.

Whether you’ve already planned or are just starting, the holidays are the perfect time to begin the dialogue. By taking the first step, you can set your family on a path to security, understanding, and peace of mind.

Take the Next Step: Schedule a complimentary call today to start your estate planning journey and ensure your loved ones are cared for no matter what.

Contact us today to get started.

This article is a service of Life & Legacy Law, a Personal Family Lawyer® Firm. We don’t just draft documents; we ensure you make informed and empowered decisions about life and death, for yourself and the people you love. That’s why we offer a Life & Legacy Planning™ Session, during which you will get more financially organized than you’ve ever been before and make all the best choices for the people you love.

The content is sourced from Personal Family Lawyer® for use by Personal Family Lawyer® firms, a source believed to be providing accurate information. This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal, or investment advice. If you are seeking legal advice specific to your needs, such advice services must be obtained on your own, separate from this educational material.